In planning for any merger or takeover, much financial analysis is undertaken to support the deal. Savings are explored through shared resources and synergies in markets are considered.

What is often given little attention is whether or not the cultures of the two organisations about to merge are compatible. Of course, they don’t have to be identical, but they shouldn’t be in direct conflict.*

The merger of Daimler Benz and Chrysler in 1997 was promoted as combining the strong German focus on engineering and quality, with American Chrysler’s strong marketing and sales functions. Some believe that the opposite actually occurred: Mercedes’ legendary quality declined, and Chrysler lost market shares as a result of pricing increases. In addition to operating losses in the billions, the capital value loss was tens of billions of dollars in the decade that followed the merger. Chrysler was subsequently sold to Fiat! So much for that visionary idea!

Another example of culture clash is where the negotiating philosophies of two entities are different. Some businesses have very transactional approaches to negotiating. There is little interest in building long-term relationships with suppliers. Major deals are always put out to tender, irrespective of the importance of the relationship.

Other businesses develop long-term relationships with their major suppliers, and this results in high levels of trust between the parties; technical and operational information can be shared with the objective of adding value. This cooperation ensures that gains are shared fairly, and disputes are resolved through negotiation rather than litigation.

In the case with conflicting negotiating philosophies, businesses were dealing with the same suppliers prior to the merger; it was not possible to continue to operate independently.

So, the question becomes ‘Which approach will eventually prove dominant and which consequences may flow from the resolution?’. It is possible to make a case for each of the approaches (competitive or co-operative) and this is best explained by the following stories.

The general manager of a manufacturing plant was undertaking an annual review of the rates paid to the subcontractors on the site. He was less than impressed when the owner of the electrical contractor arrived for the negotiations in a brand-new Rolls Royce Silver Cloud! A long-term relationship had perhaps become too comfortable for one of the parties. Those that support a transactional approach would believe that it keeps suppliers on their toes through the creation of competitive tension.

As an aside, I often reflect on the astronaut John Glenn, when he remarked that while he was hurtling through space in his rocket, he had the sobering thought that every part of his spaceship had been supplied by the lowest price tenderer!

As we know, in many situations, lowest price does not translate into best value. A state department was awarded a whole-of-government desktop computer contract three times in two years. The reason was the lowest price tenderer became insolvent two years in a row! As a result: no servicing, no backup and warranties voided.

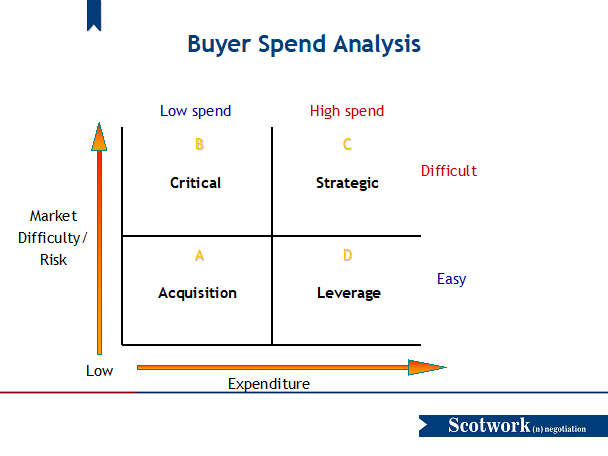

A skilled negotiator knows that one approach is not suitable in all situations and research and analysis should inform their approach. One method is to look at the amount of expenditure and the difficulty and risk of obtaining supply. A simple matrix illustrates this below.

For both critical and strategic spends, a relationship-based approach is appropriate while for acquisition and leverage categories, a transactional approach to negotiating would be appropriate.

Happy negotiating!

*Corporate culture is the set of beliefs and values that drive individual behaviour throughout organisations.